Impact

Give Your Way

Put your dollars to work right in your neighborhood. All gifts are tax-deductible–and there are ways to give strategically, in ways that’ll help meet your financial goals. Read our 2024-2025 Community Impact Statement.

Learn Moretypes of funds

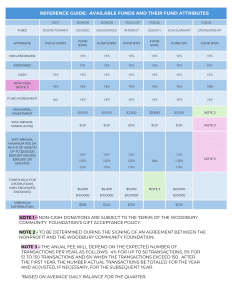

WCF is your partner in managing assets and reaching your financial/charitable goals. The WCF currently has 6 fund choices for a donor to consider.

Learn MoreLaunch a Project

Have a specific charitable idea or initiative that would benefit Woodbury? You do not have to become your own non-profit. WCF has the structure in place to work with partner funds. Learn how WCF can help.

Learn MoreGreatest Impact

The Woodbury Community Foundation works with donors — individuals, families, businesses, and organizations — to create and sustain charitable funds that will make the greatest impact in our community.

Not only can a one-time or recurring gift to Woodbury Community Foundation make an impact where it’s most needed, our donors also support specific funds and projects.

Whether you want to give from an IRA or donor-advised fund–or want to talk about legacy giving options–we’ll help you give in the most strategic way for your situation and goals.

Join us in creating change!

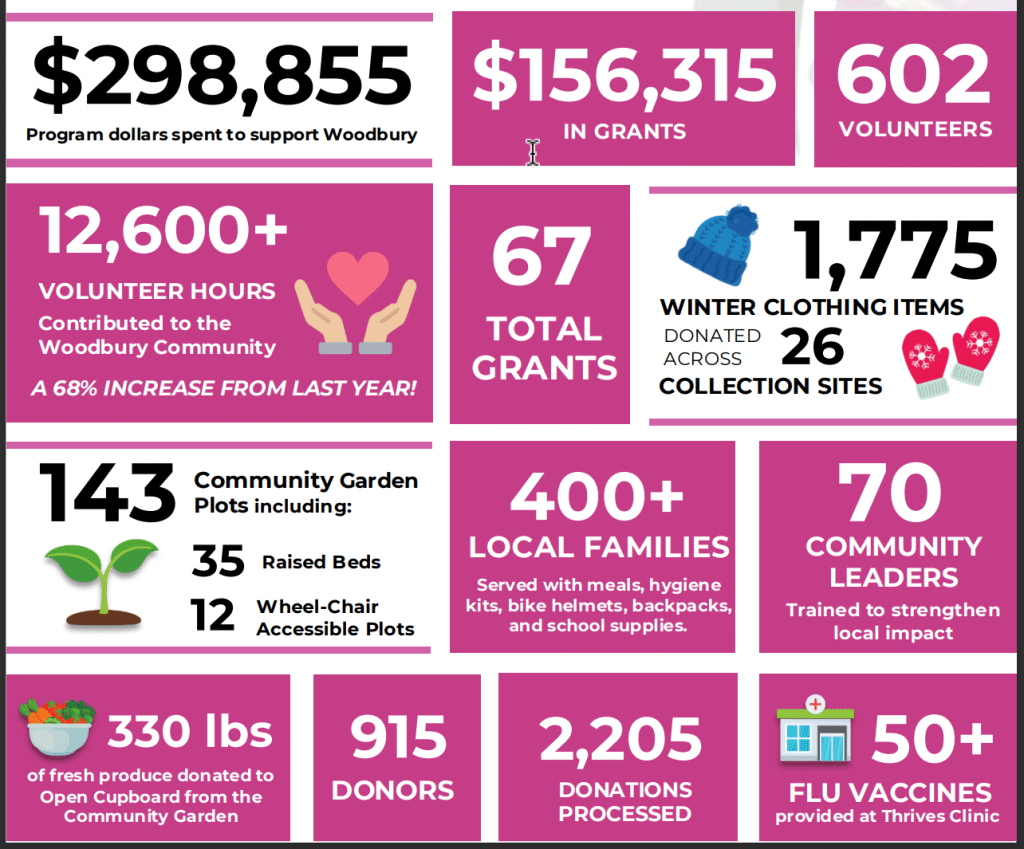

Highlights from our most recent Community Impact Statement for FY 2024-2025. Click Here to read the entire document or to request a copy our 990, contact wcf@woodburyfoundation.org.

Give Your Way

Every gift to The Woodbury Community Foundation (WCF) brings about good here in our community. But with a little knowledge, your next gift could also align with your financial goals and needs. Here are some options to consider:

Give Online

Simple and easiest way to give. One-time or recurring. Click Here to Link to our Online Portal via Paypal. You can pay by Creditcard or Paypal.

Send a Check

You can write a check to Woodbury Community Foundation and mailto: 2042 Wooddale Dr, #250 Woodbury MN 55125. Please designate where your gift should go in the memo (i.e. General Fund, Community Grants, Woodbury Thrives Fund)

to Support WCF

Employer Matching Gifts

Maximize the impact of your donation to the Woodbury Community Foundation by requesting a matching gift from your employer. Companies like 3M and Ecolab often match charitable contributions, doubling the support for our community initiatives. Most of these programs match contributions dollar for dollar, and some also provide a match for your volunteer hours. Turn your $100 donation into a $200 donation, or your 20 hours of volunteer time into a $100 donation with the help of your employer.

Gift Appreciated Stock or Securities

Do you have appreciated stock, cryptocurrency, or other securities in your portfolio? Give all or a portion directly to WCF! You’ll avoid paying tax on the appreciation, and the foundation will be able to utilize the full value of those shares immediately. Just contact your broker and indicate that you’d like to transfer stock to The Woodbury Community Foundation: Tax ID 72-1592506.

Real Estate

Make WCF a Beneficiary

Give a Legacy Gift

Make a Gift from your IRA

If you’re over 70 ½, you can make a distribution from your IRA directly to a nonprofit through a Qualified Charitable Distribution (QCD) or “IRA Rollover.” IRA funds are pre-tax, so depending on your income bracket, you could have 30+% more impact than if you were to write a check or give cash. And at age 73, Americans are required to begin taking a Required Minimum Distribution (RMD) from their IRA. Contact your retirement fund custodian to initiate a QCD and lower your taxable income for the year. There’s a maximum gift of $100,000 per year per person, and it can go to one or several nonprofits.

Give from your Donor Advised Fund

A Donor-Advised Fund (DAF) is like a “charitable checkbook” that can be set up in minutes and has benefits for just about anyone. Funds put into a DAF are immediately tax-deductible, up to 60% of your Adjusted Gross Income (AGI). Then those funds grow with interest until you decide where and when to give them to your favorite causes. It can be tax-advantageous to fund a DAF with appreciated assets–like stocks or real estate–to avoid capital gains tax and get you an immediate charitable tax deduction. Then your fund will grow tax-free until you decide where and when to grant from it to your favorite charities. Set one up through WCF today or recommend a grant to WCF from your existing DAF!

A Project

Agency and/or Endowment Partner Fund

Nonprofit organizations may establish an endowment partner fund that will provide efficient and effective stewardship of an organization’s endowment.

Examples: the Woodbury Lions Club is not a 501C(3), so they didn’t have the ability to accept tax-deductible gifts. The Lion’s created a 50-Year fund, to do fundraising for long-term success of the group and its impact in the community.

Inez Oehlke Endowment Fund – funded by Inez to fund historical preservation in the area long-term and works closely with Woodbury Heritage Society on projects. Funds stay in the community and directed to her passion area. the WCF Board directs granting based on a fund agreement.

The Bash for Brains is Fiscal Sponsorship. They are not their own nonprofit; but are actively fundraising and need day-to-day funds for expenses. WCF provides support functions in accounting, legal and fundraising.

Discretionary Fund

A discretionary fund supports WCF’s overall charitable mission of improving life in Woodbury through philanthropy. We make grants from discretionary funds to meet greatest current needs, including education, health, and human and cultural services.

Donor-Designated Funds

If you have a specific charitable organization in mind, you may name the group to receive distributions from the fund. If that group ceases to exist, or the purpose it serves becomes obsolete, the WCF board has the responsibility and authority to reapply the distributions to a similar charitable organization.

Field of Interest Funds

If you have a deeply held field of interest — such as disadvantaged children, the elderly, or the performing arts — we can help you direct grants to those causes.

For example the Anti-Racism Fund is actively fundraising from initiatives that promote Racial Equity in Woodbury, such as the Woodbury Racial Equity Collaborative and One Woodbury.

FAQs

What is a community foundation?

Why should I create a fund at WCF?

Creating a fund at WCF makes it easy and satisfying to fulfill your philanthropic wishes. Additional benefits include tax advantages, a professionally managed portfolio, and access to the support and expertise of our professional staff. Click here for more information on why you should choose the Woodbury Community Foundation: WCF - Legacy - Why a Community Foundation

Why should I create a fund at WCF instead of donating directly to an organization?

The WCF will perform due diligence on each organization, and our work with other donors and organizations often allows us to identify a need within the community that fits with your philanthropic goals. Also, you may, with our donor-advised funds, give directly to an organization when you make your own grant recommendations. For more information on leaving a legacy, click here: WCF - Legacy - Leaving a Legacy

What types of funds does WCF offer?

We offer advised, designated, discretionary, field of interest and endowment partner funds.

How much money do I need to start a fund?

You can enter into an agreement with OCF to create a step-up fund with an initial gift of $5,000 (or less), and gradually build assets toward a permanent fund. Permanent funds (including advised funds) start with an initial gift of at least $10,000.

What assets can I contribute to a fund?

We accept gifts of cash, real estate, securities and personal property. Bequests by will of cash or property, and life insurance or retirement plan assets that name WCF as the beneficiary, are other possible contributions.

How can I get my children involved?

If your children are of legal age, you can engage them as advisors on your advised fund. You can also name them as successors on the fund.

Is there a minimum amount for a grant?

Not really, but we recommend individual grants of at least $1,000, but $250 is the suggested minimum.

May I set up an anonymous fund?

Yes. Simply let us know when you submit your grant recommendations that you would like to remain anonymous.

What types of organizations may I recommend for grants?

You may recommend qualified nonprofit public charities, schools and government programs. This type of information can be found by consulting the most up to date information from the IRS.

Can I recommend a grant to an individual?

I want to make grants to a specific type of organization, but I am not familiar with any. Can the WCF help me identify some good candidates?

Yes. We can work with you to identify worthy nonprofit organizations that meet your charitable goals.

Can I use my fund to pay off a pledge I made to my another organization?

Yes this is possible. Contact us to learn more.

Woodbury Community Foundation

Woodbury Community Foundation?

Discretionary Fund

Support WCF’s overall charitable mission of improving life in Woodbury through philanthropy. We make grants from this discretionary fund to meet the greatest current community needs, including education, health, and human and cultural services.

Donor Advised Fund

With an WCF donor advised fund, you can actively participate in donating to charitable organizations throughout the community or charitable organizations of your choosing. You can also name successor advisors, such as your children, to carry on your family’s legacy of donating and giving. If you did not name successor advisors, such as their children, the WCF Board has the responsibility and authority to reapply the distribution to a similar charitable organization.

Donor Designated Fund

If you have a specific charitable organization in mind, you may name the organization to receive distributions from the fund. If that group ceases to exist, or the purpose it serves becomes obsolete, the WCF will work with you to reapply the distributions to another charitable organization. If you did not name successor advisors, such as their children, the WCF Board has the responsibility and authority to reapply the distribution to a similar charitable organization.

Field of Interest Fund

More on Field of Interest Funds

Fiscal Agency Fund

If you have a deeply held field of interest, such as disadvantaged children, or the performing art, etc., the WCF can help you direct grants to those causes. The Foundation has a statement of values-based community support that prohibits donations to organizations whose practices run counter to the community’s best interests (e.g., hate groups…).

Fiscal Sponsorship Fund

A community volunteer collaboration may establish a partnership fund that will provide efficient and effective stewardship of an organization’s fund raising for a program or project designated to serve the needs of the Woodbury Community.

Scholarship Fund

Allows interested donors the opportunity to create a philanthropic fund from which they may make recommendations to the Foundation Board of Directors on distributions made from the fund to their choice of a qualified educational organization(s).

Questions

Why should I create a Fund at the WCF instead of donating directly to an organization?

Why should I establish a Fund at the WCF?

I am not sure who is deserving, how can I get help?

How can I establish and contribute to a Fund?

What is a Fund going to cost me?

Can I get my children involved with my philanthropy?

How will I be informed of how the Fund’s Investments are doing?

Can I make a distribution, grant, or donation from the Fund at any time?

My Fund balance is over the threshold, how do I make a donation?

Complete a Grant Distribution Request on the donor portal and submit it to the WCF for its review and approval. Once the WCF does its due diligence to determine that the designated donation or grant recipient is still registered as a non-profit, the donation will be processed. It may take up to 15 business days before the donation/grant is sent out.

Who can I recommend for a distribution grant or donation?

Is there anything I can’t recommend for a distribution, grant or donation?

within every WCF Fund?

An Endowed Fund: These funds are permanently restricted and only the income from initial and subsequent contributions may be distributed to charitable organizations or for charitable purposes. These Funds also have a threshold of $10,000 or higher before any distribution is allowed. This allows the Fund to continue supporting charitable causes in perpetuity.

Donor Advised Fund

Explore the Flexibility and Impact of Donor-Advised Funds

A Donor-Advised Fund (DAF) is like a “charitable checkbook” that can be set up in minutes and has benefits for just about anyone. Funds put into a DAF are immediately tax-deductible, up to 60% of your Adjusted Gross Income (AGI). Then those funds grow with interest until you decide where and when to give them to your favorite causes. It can be tax-advantageous to fund a DAF with appreciated assets–like stocks or real estate–to avoid capital gains tax and get you an immediate charitable tax deduction. Then your fund will grow tax-free until you decide where and when to grant from it to your favorite charities. Set one up through WCF today or recommend a grant to WCF from your existing DAF!

To inquire about how the Foundation can set up a DAF, please feel free to give us a call at 651-505-7024 or send us an email at wcf@woodburyfoundation.org